These Are The 8 Triggers For A New Financial Crisis

Authored by Satyajit Das (Author of A Banquet of Consequences), via The Independent,

There are a number of potential triggers to a new crisis.

The first potential trigger may be equity prices.

Authored by Satyajit Das (Author of A Banquet of Consequences), via The Independent,

There are a number of potential triggers to a new crisis.

The first potential trigger may be equity prices.

Following this weekend's news that the massive Calgary fire, while still spreading, may soon be under control courtesy of some wet weather and favorable winds, as well as the stunner from Saudi Arabia that Ali al-Naimi was out, replaced with a puppet of the hawkish deputy drown prince Mohammed bin Sultan - a succession many saw as bearish for future oil prices - algos had refused to give up on recent momentum, and pushed WTI just why of $46/bbl overnight.

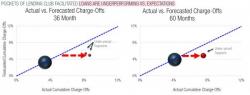

Back in February we showed that it is not only China which is troubled by non-performing loans: America's own nascent private Peer 2 Peer industry was having very similar issues, evident most notably in the books of category "leader" LendingClub, whose write-offs had soared to nearly double the company's own forecasts.

The overnight session has been one of alternative weakness and strength: it started in China where stocks tumbled 2.8% to a two month low following an unexpected warning in the official People's Daily mouthpiece that debt and NPLs are too high, not to expect more easing will come, and that the Chinese Economy’s performance won’t be U- or V-shaped but L-shaped.

With stocks the biggest beneficiary of the late January "Shanghai Accord" (that shall not be named), it stands to reason that the US Dollar was the biggest loser. Sure enough, overnight the WSJ writes that the "powerful rallies that have lifted stocks, crude oil and emerging markets for the past three months have one important thing in common - the falling dollar - and investors are growing anxious that it could prove to be the weak link."

But is a strong dollar about to make another appearance and unleash the next leg lower in risk assets?