"The Insanity, It Seems, Is Not Over" - Vancouver Home Prices Are Now Literally "Off The Chart"

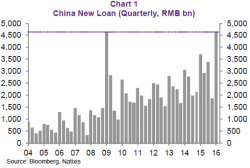

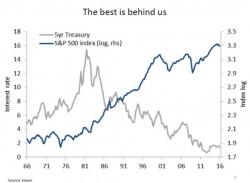

In the past several months we have dedicated numerous articles to demonstrate the sheer lunacy of the Vancouver real estate market with isolated cases in which Vancouver houses, whether abandoned or in phenomenal shape, would sell for millions of dollars above asking just because Chinese buyers would pay any price in their rush evade capital controls and launder cash in northeast Canadian real estate. Perhaps the most egregious example took place two weeks ago when we wrote "Valued At $16 It Sold For $68 Million "In 7200 Seconds" - The Inside Story Of Vancouver's Wildest Property Deal."