Here Is The One Commodity That Is More Volatile Than Bitcoin

Normal

0

false

false

false

false

EN-US

X-NONE

X-NONE

Normal

0

false

false

false

false

EN-US

X-NONE

X-NONE

Normal

0

false

false

false

false

EN-US

X-NONE

X-NONE

Normal

0

false

false

false

false

EN-US

X-NONE

X-NONE

Authored by Tsvetana Paraskova via OilPrice.com,

As we roll into 2018, analysts and investors are more optimistic that the oil market will further tighten next year and support higher oil prices, but rising U.S. shale production will likely cap any significant price gains.

On the demand side, expectations are that global economic growth will support solid oil demand growth.

Ahead of last night's collapse in cryptocurrencies, Ron Paul warned CNBC viewers that they had become an asset thatrivals the bubble he sees in stocks...

"I think it's going to continue to do exactly what it's doing. It's going higher and it's going lower," he said Tuesday on CNBC's 'Futures Now'.

"We can look at what's happening now, which to me is a climactic end of QEs."

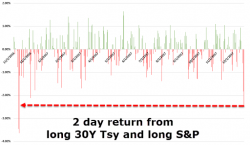

Earlier this week, as Trump's tax reform was finally being voted through Congress, we showed that in a surprising market reaction, total asset returns - those combination of S&P and 30Y Treasurys - saw their biggest two-day drop since last December, a shock which led to one of the biggest declines for risk-parity investors in months.

Last week, Mike Novogratz surprised more than a few market participants by telling CNBC's Fast Money that he was bringing forward the launch date of his crypto hedge fund; today he killed those plans.

On December 12th, Novogratz said he thinks bitcoin could hit $40,000 in 2-3 months. The Galaxy Fund was supposed to launch of December 15th.

http://player.cnbc.com/p/gZWlPC/cnbc_global

Today, Novogratz has shelved plans to launch his fund, warning that: