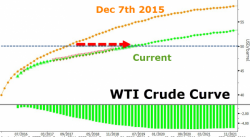

Saxo Warns Further Upside For Crude Hard To Achieve After Market "Change Of Focus"

The dollar's gyrations remain a key source of inspiration for traders with the fundamental focus continuing to switch between falling US and rising OPEC production, according to Saxo Bank's Ole Hanson.

The nervousness and negative price action seen this week was triggered by a change in focus from falling US production towards the rising supply from others, especially within OPEC. Having seen calendar 2017 almost hit $50 last week the realisation that further upside may be hard to achieve may has helped trigger increased demand for protection.