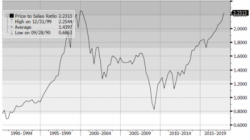

Bubble Watch: The Fed KNOWS We're in a 1999-Type Mania...

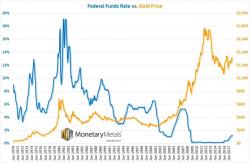

The Fed raised rates another 0.25% the week before last.

This marks the 5th rate hike since the Fed embarked on its policy tightening in December 2015 and the fourth rate hike in the last 12 months. The Fed’s latest statement also indicates it plans on raising rates three more times in 2018.