Here Is Mario Draghi's Advice To Europe's Crushed Savers

Yesterday, the ECB sent Benoit Coeure out to explain to the uneducated masses that the concern over negative interest rates is overdone because not everyone is saving money.

Yesterday, the ECB sent Benoit Coeure out to explain to the uneducated masses that the concern over negative interest rates is overdone because not everyone is saving money.

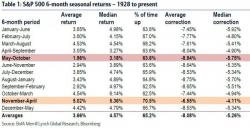

"Sell in May and go away" -- the old equity-market adage still holds water, but, as Bloomberg's Mark Cudmore explains, it's important to note how the seasonals have evolved since the great financial crisis.

In its original usage, the motto implied it’s advisable to cash out of equities at the end of May and enjoy a long summer of relaxation before returning to invest again. It wasn’t just a flippant saying; the facts tallied with the intuition.

One week ago when Morgan Stanley was lamenting the relentless buying by algos (or as he called them "macros" and saying "forgive the macros – they know not what they do") who have taken over the function of setting the price of oil despite "increasingly bearish fundamentals", the bank's analyst Adam Longson asked one question: will the summer of 2016 be a rerun of last summer when oil jumped from $45 to $60 only to tumble into the end of the year.

In a disappointingly similar tone to the warnings, threats, and promises sent to Congress in 2008 when demanding the banks get their bailout (or else), Treasury Secretary Jack lew has released a letter he sent to Congress warning that if Puerto Rico's situation is not "fixed" in an "orderly" manner "quickly" then the nation will face "cascading defaults."

Any moment now we expect Paul Krugman to come out with an op-ed suggesting that not just Time magazine, but Charlie Munger is the latest to join the ZH payroll, following some unexpected comments by Warren Buffett's right hand man earlier today on CNBC when he said that "the U.S. is looking more like Japan given the prolonged low-interest-rate environment."