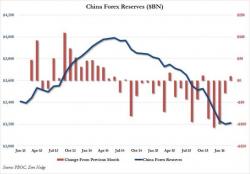

IIF Ruins The Party, Predicts Another $420 Billion In Chinese Capital Outflows This Year

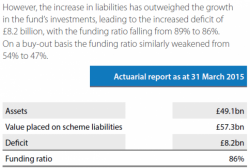

In early 2016, the biggest global macroeconomic risk factor was the accelerating capital outflows out of China over fears of currency devaluation (or simply because the local population knows better than anyone just how dire to domestic situation is and is rushing to park its assets offshore) and with good reason: after the PBOC burned through $1 trillion in reserves to offset capital flight starting in the summer of 2014, even the IMF chimed in with a concerned report suggesting China may have at most another half a trillion "buffer" left before it runs into illiquid assets which would pro