BofA's "Economic Shock" Bear Case In 4 'Fragile' Charts

Outside of an exogenous geopolitical event - which given the way the world is tilting is becoming an increasingly likely occurrence - BofAML believes a bear market case is strongly supported by the probability of an economic shock most likely be tied to credit where signs of stress are building the most.

There are four simple factors that suggest problems ahead...

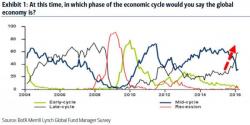

1. Investors are starting to believe we’re “late cycle”