"China Is Hoarding Crude At The Fastest Pace On Record"

In the aftermath of China's gargantuan, record new loan injection in Q1, which saw a whopping $1 trillion in new bank and shadow loans created in the first three months of the year, many were wondering where much of this newly created cash was ending up.

We now know where most of it went: soaring imports of crude oil.

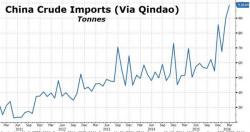

We know this because as the chart below shows, Chinese crude imports via Qingdao port in Shandong province surged to record 9.86 million metric tons last month based on data from General Administration of Customs.