Inflation is the Goal… and Central Banks Will Stop at Nothing to Get It!

The markets are prepping for the next massive round of QE.

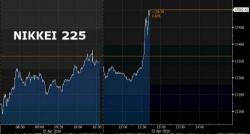

As I noted earlier this week, NIRP has been entirely ineffective at generating Central Bankers’ desired “inflation.” The ECB has cut rates into NIRP four separate times only to find itself with 0% inflation. In contrast, the Bank of Japan has cut rates into zero once and immediately fallen back into a deflationary collapse.

Indeed, NIRP has even been a dud when it comes to pushing stocks higher.