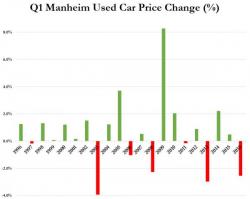

Used-Car Inventories Surge To Record Highs As Goldman Fears "Spillovers From Demand Plateau"

Just 24 hours ago we explained the beginning of the end of the US automaker "house of cards," detailing how the tumble in used-car-prices sets up a vicious circle as Goldman warns "demand has plateaued." This is most evident in the surge in pre-owned vehicle inventories to record highs, forcing, as WSJ reports, dealers to lower prices, further denting new-car pricing.