Gold & Silver Surge Amid Crude & Copper Carnage

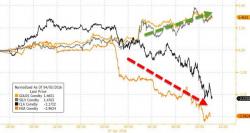

As the growth mirage fades (and short-squeeze ammo runs out), so crude and copper carnage is reappearing. Amid its biggest plunge since early Jan, Copper is now down 10 of the last 12 days and crude is plunging back towards it 50-day moving average. Amid this bloodbathery, precious metals are bid as Saxo Bank sees Gold "heading back to its highs and beyond."

Copper & Crude carnage continues as PMs are bid...

The biggest plunge in copper since September 2015...