![]()

See this visualization first on the Voronoi app.

Use This Visualization

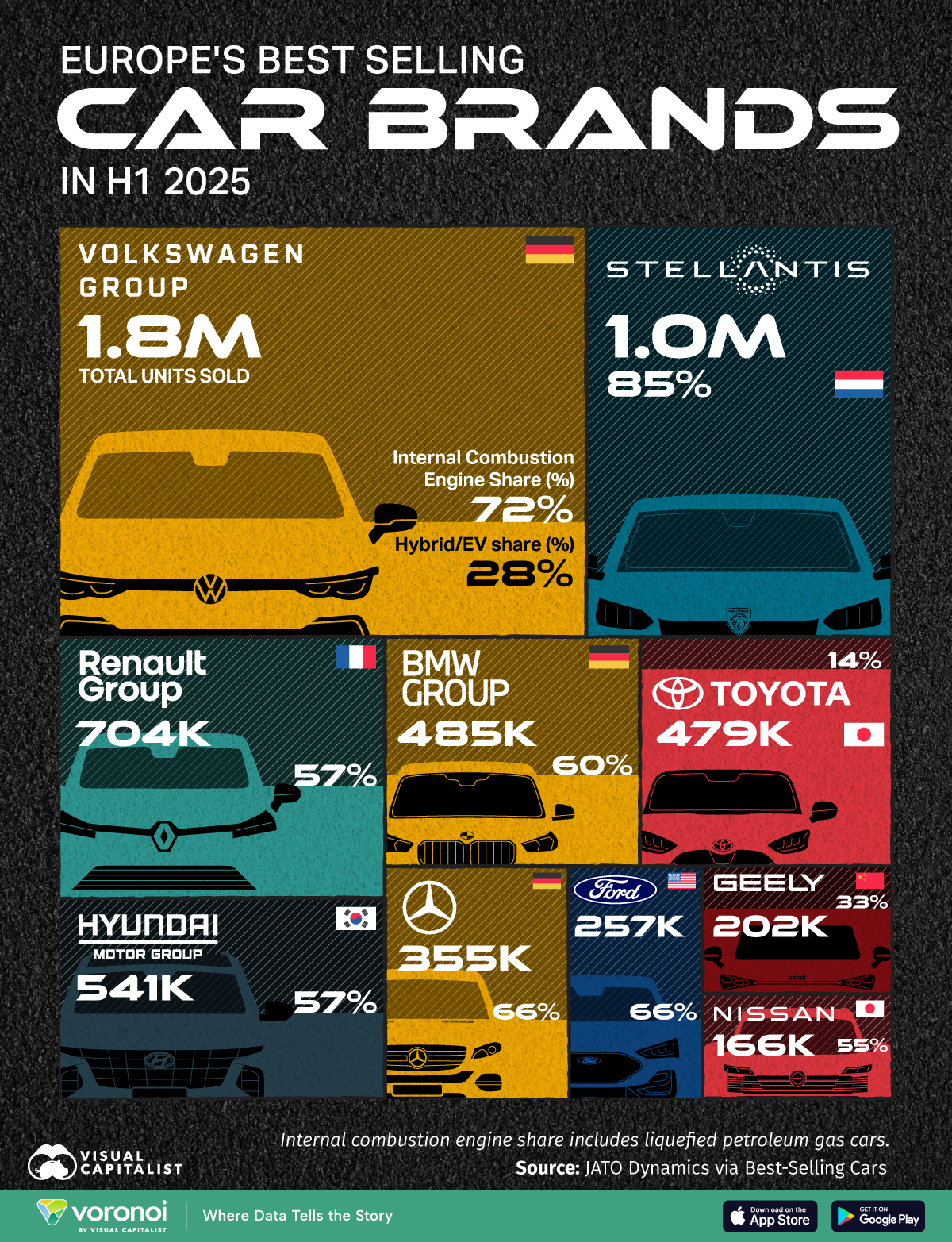

Ranked: Europe’s Best-Selling Car Brands in 2025 So Far

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Volkswagen Group was Europe’s top-selling car brand with 1.8 million units sold, 72% of which were internal combustion engine (ICE) powered.

- Toyota was the sixth best-selling car brand in Europe with 479,000 sales in H1 2025 and it had the highest share of electric and hybrid vehicles sold at 86%.

Which car brands are winning Europe’s competitive auto market in 2025, and how much of their sales are electric and hybrid vehicles?

This visualization shows the best-selling car brands in Europe in the first half of 2025 so far using data from JATO Dynamics via Best-Selling Cars. It also showcases the share of internal combustion engine (ICE) sales vs. hybrid and electric vehicle (EV) sales for each car brand.

Volkswagen Group Leads European Car Sales

Volkswagen Group remains Europe’s top car seller, with over 1.8 million units sold in the first half of 2025, as seen in the data table below.

| Brand | Cars sold in Europe in H1 2025 | Internal combustion engine share of sales | Hybrid and electric vehicle share of sales |

|---|---|---|---|

| Volkswagen Group | 1,800,504 | 72% | 28% |

| Stellantis | 1,044,983 | 85% | 15% |

| Renault Group | 704,023 | 57% | 43% |

| Hyundai-Kia | 540,917 | 57% | 43% |

| BMW Group | 485,299 | 60% | 40 |

| Toyota | 478,686 | 14% | 86 |

| Mercedes-Benz | 355,162 | 66% | 34 |

| Ford | 257,337 | 66% | 34 |

| Geely Group | 202,230 | 33% | 67 |

| Nissan | 165,645 | 55% | 45 |

While still heavily reliant on combustion engines (72% of sales), Volkswagen has steadily increased its electric offerings, which now represent 28% of sales.

Volkswagen maintains a significant lead over Stellantis, the second-largest car brand with 1.04 million units sold in H1 2025. Stellantis has the highest share of combustion cars sold among the top 10 car brands at 83%, with just 17% of sales coming from EVs or hybrid vehicles.

Europe’s Emerging Car Brand Competitors

Renault Group (704,023) and Hyundai Motor Group (540,917) were third and fourth respectively, with both of them having 43% of their sales coming from hybrids or EVs.

Premium brands like BMW group (40% electrified) and Mercedes-Benz (34%) are also rapidly transitioning towards more electric and hybrid offerings.

Meanwhile, Chinese-owned Geely Group (with 67% of sales EV or hybrid) is gaining ground in Europe with competitive EV offerings and ranked ninth in total sales with 202,230 just ahead of Nissan (165,645) and behind Ford (257,337).

Toyota’s Electrification Edge in Europe

Toyota ranks sixth with nearly 479,000 cars sold but stands out for its electrification strategy.

A remarkable 86% of its European sales were hybrids or EVs, the highest share of any top automaker. Toyota’s strong hybrid lineup and growing adoption of electrified models in Europe has helped it compete against larger-volume and domestic brands.

Learn More on the Voronoi App ![]()

To learn more about EV adoption around the world, check out this chart on global EV adoption over time on Voronoi, the new app from Visual Capitalist.