Chairman Of Insolvent Chinese Steel Company Hangs Himself Day Before Bond Maturity

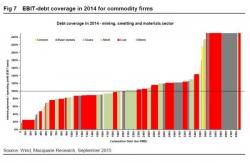

Back in October when we first looked at ground zero of the commodity price collapse, we found something striking: as of the end of 2014, one half of China's commodity companies with corporate debt were totally insolvent - based on Macquarie data they were unable to cover even one interest payment (let along debt maturity) with existing cash creation.