For Gold, "Tightening Isn't Frightening" Says HSBC

Gold has historically rallied for at least 100 trading days after the first hike by the FOMC, but as HSBC's Jim Steel explains, this time it could be longer. Steel sees three key reasons to remain bullish and forecasts USD1,300/oz this year (though warns that beyond that level, physical demand may weaken and help curb further rallies.)

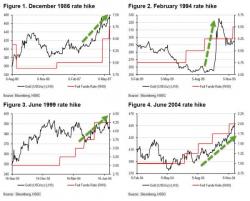

Tightening and gold Background: The end of the long-run bull market