Someone Is Wrong

You decide...

You decide...

The markets' various indicators of 'Brexit Risk' are all elevated this morning post-Belgium-attacks.

GBPUSD is tumbling...

But most crucially, the cost of protection against pound currency swings over EU currency swings has jumped to the highest ever signalling the highest market-impled risk of Brexit so far.

As Fed's Lockhart warned yesterday, the contagious risk of Brexit will likely spread to the US economy - so this is not to be ignored.

WTF is going on? Richmond Fed's manufacturing survey exploded from -4 to 22 in March, beating expectations of 0 by the most ever). This is the 3rd highest print ever (in 23 years) driven by the highest level of New Orders in 6 years. Inventories tumbled, prices paid and received jumped, and expectations for future orders surged (despite stagnation in expectations for jobs).

WTF!

WTF!-er...

WTF!-est...

As everything exploded...

From the survey:

Given the extraordinary jumps in several regional Fed surveys, hope was rife that US Manufacturing PMI's flash print would jump... it didn't. Hovering near multi-year lows at 51.4, PMI missed expectations of 51.9 by the most since Aug 2013. With record highs in wholesale inventories, Markit claims that "pre-production inventories decline at the steepest pace in over 2 years." The blame for this plunge: dollar strength, weak global demand, and Trump.

Not recovering...

As Markit explains,

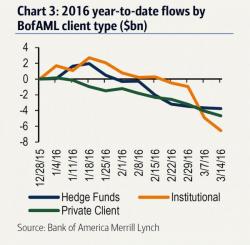

First it was five weeks; then it was six straight weeks; then a whopping seven weeks of selling in a row even as the market rose 1.1% higher. And now, in an unprecedented for a bear market rally move, the "smart money", i.e., BofA's hedge funds, institutional, and private clients, havbe sold stocks for a whopping 8 consecutive weeks.