Goldman Throws Up On Global Easing Party, Warns US Economy Close To Overheating

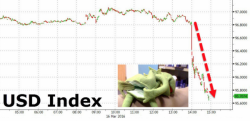

“The dollar rally is far from over,” Goldman’s Robin Brooks said, just hours before this week’s FOMC announcement.

“We expect the Fed to signal that it wants to continue normalizing policy, which means three hikes this year and four in 2017,” Brooks continued. “Overall, our sense is that the outcome will be more hawkish than market pricing.”