Why The Fed Is Paralyzed - Its Economic Model Is Junk

Submitted by Jeffrey Snider via Alhambra Investment Partners,

Submitted by Jeffrey Snider via Alhambra Investment Partners,

From Guy Haselmann of Scotiabank

BURP

Yesterday’s FOMC meeting and press conference generated widespread unease. My personal uncomfortable feeling was reminiscent of a time many decades ago when a date stood me up and provided an excuse that made little sense. Simply put, the combination of the FOMC’s forecasts, economic assessment, and guidance on the future path of interest rates were incongruous and disconnected to their ‘data dependency’ message.

Submitted by Gail Tverberg via Our Finite World blog,

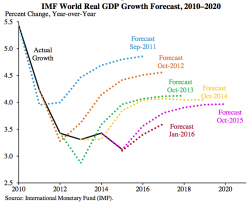

Economic growth never seems to be as high as those making forecasts would like it to be. This is a record of recent forecasts by the International Monetary Fund:

Figure 1. World GDP Forecasts by the International Monetary Fund.

As CS' Josh Lukeman notes, the degree of hedging we’re seeing as we go higher illustrated in the CS Fear index (now at all-time highs) suggests institutional investors are not believers in the equity rally

CSFB's "Fear" Indicator has never been higher...

For a succinct explanation of what this far less popular indicator captures we use a handy definition by SentimentTrader:

EXPLANATION:

On February 12, Jamie Dimon made headlines when he bought 500,000 shares, or some $26 million worth of JPM stock which coming one day after the market hit its lowest point in the recent selloff, has become known as the "Dimon Bottom." Was it just good timing or was there something more to the purchase some wondered.