S&P Clings To Technical Support Despite Oil & Gold Dump

What could go wrong?

Today was all about the 200-day moving average for the S&P 500...2019.40 was all that mattered...

What could go wrong?

Today was all about the 200-day moving average for the S&P 500...2019.40 was all that mattered...

On Sunday, millions of Brazilians took to the streets to call for the ouster of President Dilma Rousseff, who is thought to have cooked the fiscal books in 2014.

She’s not yet implicated (directly anyway) in the long-running Carwash probe, but some think that may change soon as the investigation seems to get closer and closer to her officer with each passing week.

But it’s not just corruption that Brazilians are fed up with.

Crude oil prices "appear to have reached their peak for now," warns Saxo Group's Ole Hanson as he explains there are several reasons why.

Among the chief concerns putting a damper on Brent prices is an upcoming meeting between OPEC and non-OPEC producers to discuss a potential output freeze, he says. Iran is now saying it will not curb production before it has reached 4 million barrels a day.

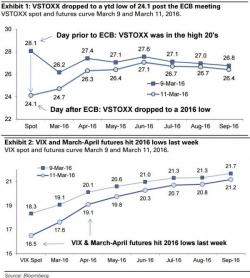

With one central bank meeting down, but two to go, VIX and VSTOXX (Europe's VIX equivalent) have plunged to 2016 lows discounting any 'events' upsetting the complacency anytime soon. However, as Goldman's options strategists note, the medium-term skew (3M to 1Y) are at or near record highs as traders prepare for turbulence amid 'Brexit', US elections, and of course the inevitable 'Fold or No Fold' Fed decisions later in the year.

One month ago, we noticed the latest "shoe to drop" in the global credit rout, when as a result of soaring downgrades to energy companies' credit ratings, the Collateralized Loan Obligations (CLO) market went into a state of frozen animation, leading to a standstill in new CLO issuance.