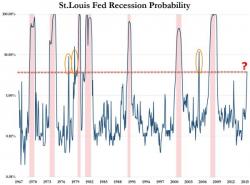

HY Credit Spreads Have Never Been This High Outside Of A Recession

Today marked the 13th consecutive day of positive HY fund flows (bringing total to $8.6bn)...

But as Credit Suisse explains, the nature of this demand is 'different'...

Investors likely using the ETFs as a placeholder for cash in the absence of new supply, with HY issuance down ~74% year on year.

With ballooning ETF inflows the past few weeks, the liquid sector has become increasingly vulnerable to ETF cash rotating out upon the availability of new supply.