Why The Bulls Are Hoping For A Weak Jobs Number

In half an hour, the BLS will report the February unemployment rate and payrolls number which is expected to print as follows:

In half an hour, the BLS will report the February unemployment rate and payrolls number which is expected to print as follows:

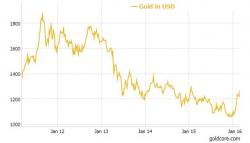

Gold has surged another 4% this week to bring year to date gains to 20% in dollar terms, 19% in euro terms and 24% in sterling terms. We were interviewed by PickingAlpha.com yesterday afternoon and looked at what is currently driving gold prices higher in all currencies.

Last summer, millions of farmers, housewives, security guards and a litany of other newly minted daytraders, opened enough new stock trading accounts for evey man, woman and child in Las Angeles - in just one month.

The excitement was palpable - and before anyone knew it, the proliferasion of around a half back door margin lendings chanells pumpped an additional CNY1.5 trillion into an already frothy market. Without putting too fine a point on it, didn't work, it started to uravel and the party got concerned about social instability.

Two days ago, Credit Suisse reported something which had been rather visible in the markets: an onslaught of retail buying had entered the junk bond market in which institutions were delighted to sell to retail bagholders, in the process repricing the entire HY space if only briefly.

Overnight, fund flow tracking service EPFR confirmed this when it reported that US high yield funds recognized a $5.27bn (+2.8%) inflow for the week ended March 2nd, the largest ever in terms of $AUM and the 2nd largest on a percentage basis.