"Worse May Be To Come" As US Services Slump Into Contraction, Business Confidence At Record Lows

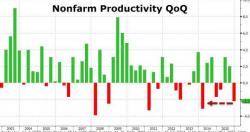

From the narrative-destroying 49.8 preliminary print for US Services PMI (the lowest since the government shutdown in 2013), today's final February Services PMI printed an even worse 49.7 (below 50.0 expectations) even as stocks have soared in the last 2 weeks. Business confidence tumbles to its lowest since Aug 2010 (record lows). This drops the composite PMI to a dismal 50.0, implying negative GDP growth in Q1.