Published

2 hours ago

on

August 18, 2025

| 17 views

-->

By

Jenna Ross

Graphics & Design

- Amy Realey

The following content is sponsored by Terzo

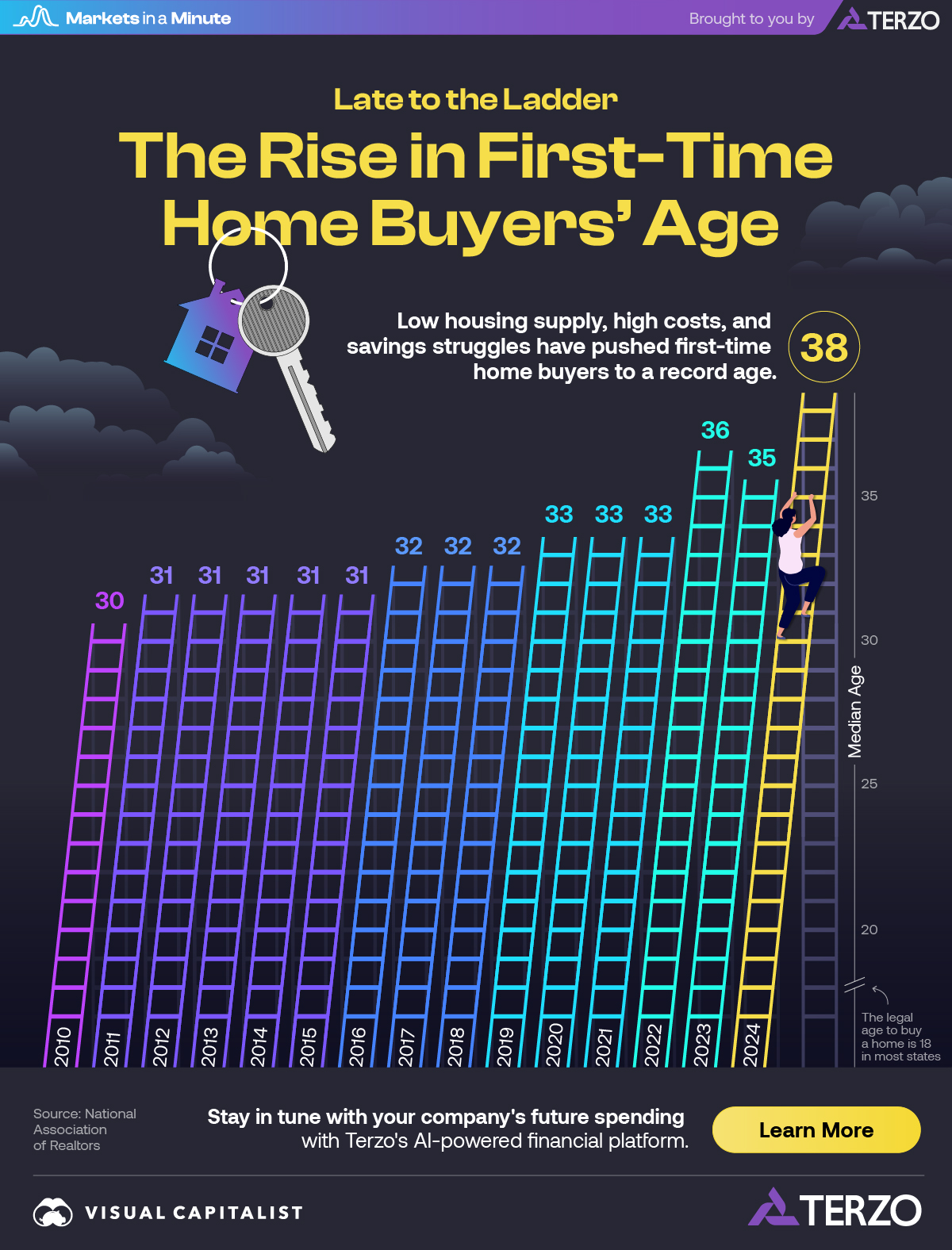

The Rising Age of First-Time Home Buyers

Key Takeaways

- The median age of first-time home buyers has been rising over time.

- In 2024, the median age hit 38, the oldest ever recorded.

- Low housing supply, high costs, and savings struggles have all contributed to the slower start to home ownership.

Buying a home for the first time is a milestone many associate with adulthood. But for today’s first-time home buyers, that goal keeps slipping further into the future.

This Markets in a Minute graphic, created in partnership with Terzo, shows how the age at which people in the U.S. buy their first home has been climbing over time.

Later to the Property Ladder

Using data from the National Association of Realtors (NAR), we explore how the median age of first-time home buyers has changed from 2010 to 2024.

In 2010, the median age was 30, little changed from NAR’s first records of age 29 in 1981. However, the last 15 years have seen quite a shift.

| Year | Median Age of First-Time Home Buyers |

|---|---|

| 2010 | 30 |

| 2011 | 31 |

| 2012 | 31 |

| 2013 | 31 |

| 2014 | 31 |

| 2015 | 31 |

| 2016 | 32 |

| 2017 | 32 |

| 2018 | 32 |

| 2019 | 33 |

| 2020 | 33 |

| 2021 | 33 |

| 2022 | 36 |

| 2023 | 35 |

| 2024 | 38 |

Source: National Association of Realtors

By 2024, people buying homes are much older, hitting a record of 38. The share of first-time home buyers on the market also dropped from 32% to 24%.

Challenges for First-Time Home Buyers

Many are arriving late to the property ladder—and for good reason. The first few rungs have become harder to reach, or in some cases, feel entirely broken.

High home prices and elevated mortgage rates have made homes much less affordable, especially with limited housing inventory. Incomes also haven’t been keeping up with rising home costs, with the price-to-income ratio climbing from 3.5 in 1985 to 5.0 in 2025.

On top of this, many say high rent, student loans, credit card debt, and car loans are hurdles to saving for a down payment.

A New Financial Profile for Beginner Homeowners

Today’s first-time home buyers are climbing a ladder with steeper steps and fewer footholds. As a result, they tend to be older and wealthier before taking the first step.

The typical first-time buyer now earns around $97,000 annually, a jump of $26,000 since 2022. In some states, the income needed to buy a home is much higher—as high as $229,000 in Hawaii.

When it comes to a down payment, people buying homes for the first time put down 9% on average. While the bulk use savings for down payments, a quarter of newbie buyers used loans or gifts from friends and family.

Have financial goals for your business? Use Terzo’s AI-powered financial platform to track your company’s spending and stay on course.

More from Terzo

-

Markets2 weeks ago

Unpacking Real Estate Ownership by Generation (1991 vs. 2025)

The Silent Generation’s share of real estate has dropped dramatically as people age, but how have Baby Boomers, Gen X, and Millennials fared?

-

Business3 weeks ago

America’s Economic Engines: The Biggest Industry in Every State

Real estate is the biggest industry by GDP in 26 states. Find out why it dominates—and what fuels the rest of the country.

-

Maps1 month ago

Mapped: Manufacturing as a Share of GDP, by U.S. State

Tariffs are rising to boost American-made goods. Which states gain the most—and least—from manufacturing today?

-

Technology2 months ago

Profit Powerhouses: Ranking The Top 10 U.S. Companies by Net Income

Collectively, the ten most profitable U.S. companies have a net income of $684 billion—more than the entire GDP of Belgium.

-

Money2 months ago

Millionaire Hubs: Mapping the World’s Wealthiest Cities

New York City has the highest millionaire population globally. Which other cities attract the world’s wealthiest?

-

Economy2 months ago

Tomorrow’s Growth: GDP Projections in Key Economies

The global economy is expected to have slighter slower growth going forward. Which countries are on track to have the biggest GDP increases?

-

Money3 months ago

Mapped: Interest Rates by Country in 2025

The U.S. has kept their target rate the same at 4.25-4.50%. What do interest rates look like in other countries amid economic uncertainty?

-

Markets4 months ago

U.S. Housing Prices: Which States Are Booming or Cooling?

The national housing market saw a 4.5% rise in house prices. This graphic reveals which states had high price growth, and which didn’t.

-

Investor Education5 months ago

The Silent Thief: How Inflation Erodes Investment Gains

If you held a $1,000 investment from 1975-2024, this chart shows how the inflation rate can drastically reduce the value of your money.

-

Politics5 months ago

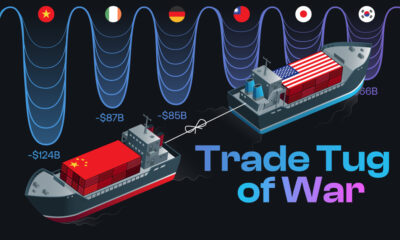

Trade Tug of War: America’s Largest Trade Deficits

Trump cites trade deficits—the U.S. importing more than it exports—as one reason for tariffs. Which countries represent the largest deficits?

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up