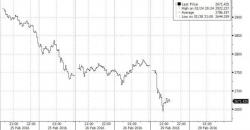

China Stocks Crash: Down More Than 4% To Fresh 15 Month Lows

It all started off well-enough: the USDJPY was modestly lower but noting big, then the Yuan was fixed a little less modestly lower - well ok, it was the lowest fixing in 8 weeks confirming China just couldn't wait for the Shanghai summit to be over - and then suddenly the Chinese market realized what we said earlier in the weekend, namely that with the much anticipated G-20 meeting a complete dud, and with no major stimulus on the horizon, suddenly the trapdoor below Chinese stocks opened and the Shanghai Composite has started the new month tumbling over 4%.