Get Back To Work Mr.Draghi - Deflation "Monster" Spreads Across Europe

Today's current inflation data dump from across the European nations appears to confirm forward inflation expectations trend (plumbing new record lows). With a considerably bigger than expected decline in prices , pushing Germany, Spain, and France back into deflation, pressure is mounting on Mr.Draghi. As one EU economist exclaimed, "the data send a clear message to the ECB and the only question that remains now is how bold action would be."

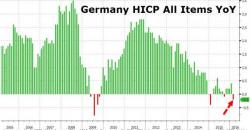

Germany tumbles back into deflation...