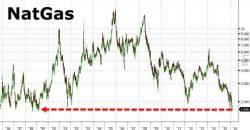

NatGas Tumbles To 16-Year Lows

More "unequivocally good" news. On the heels of a smaller than expected drawdown in natural gas inventories (-117 vs -135bcf), Nattie futures have tumbled to their lowest intraday level since 1999...

And while the oil market is "glutted," some are arguing the NatGas market is even more so...

OilPrice.com's Nick Cunningham warns, while the glut in oil is expected to continue for the next year or so before balancing in late 2016, the pain for liquefied natural gas (LNG) could be just beginning...