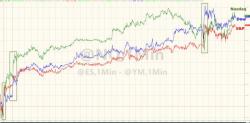

Nasdaq Tops 7,000 For First Time Ever As VIX Crashes

Having passed 6,000 for the first time in April, Nasdaq has now soared 17% since then to surpass 7,000 today...

As soon as cash markets closed last Friday (quad witch), US equity futures spiked... then spiked again on Sunday night's open, and again at the US equity cash open this morning...

And VIX has been crushed this morning...