The Stock Market & The FOMC - An Astonishing Statistic

Authored by Pater Tenebrarum via Acting-Man.com,

An Astonishing Statistic

Authored by Pater Tenebrarum via Acting-Man.com,

An Astonishing Statistic

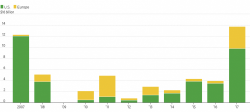

In 2017, stock issuance by SPACs has made a new post-crisis high, surpassing the last peak in 2007 which saw the equity market peak in October of that year prior to the crisis. Before we go any further, we’d better define a "SPAC" just in case you’re unfamiliar with the acronym, although they are also often known as “blank check” companies or “blank check" IPOs. From Investopedia.

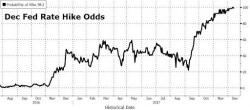

In previewing today's FOMC decision, which will also be Janet Yellen's last rate hike decision and press conference before she is replaced by Jay Powell, there is a TL/DR version, which is summarized by the chart below and which shows that according to the market, the probability of a rate hike today is 100%... which is really all you need to know as the rest is Fed explanations and forecasts, both of which are always wrong:

Desperate to get more excited about today's episode of central planning? Below is RanSquawk's full preview of what to expect from Yellen today:

It’s fairly easy to categorize Patrick Byrne, the founder of Overstock.com, as a visionary, although he is usually described in less glowing terms in the mainstream media, a typical adjective being “controversial”. Byrne founded the $1.4 billion internet retailer of mainly “closeout” merchandise in 1997. In January 2014, Overstock became the first major online retailer to accept Bitcoin in payment for goods. Byrne explained how he became an advocate of cryptocurrencies in an interview with Adam Taggart of PeakProsperity.com.

The Fed concludes its final FOMC meeting of the year today.

The entire financial world expects the Fed to raise rates a final time. This will mark the fifth rate hike since December 2015, and the fourth of the last 12 months.

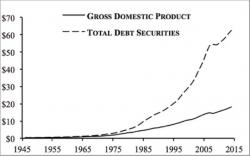

Throughout this time period, the Fed has routinely stated that it is confused as to why inflation is “too low.”

Inflation is not too low. The method the Fed uses to measure inflation is intentionally incorrect. As a result, the official inflation numbers reflect whatever the Fed wants, as opposed to reality.