2016: The Year Wishful Thinking Fails

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

If we collectively choose wishful thinking, catastrophic consequences are guaranteed.

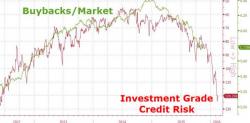

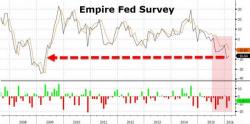

Wishful thinking has been an integral driver of the "recovery" 2009-2015: asset bubbles aren't bubbles, central bank policies are brilliantly successful, unemployment has dropped to levels of full employment, and so on.

The problems with wishful thinking that I describe in my book A Radically Beneficial World are becoming more apparent by the day: