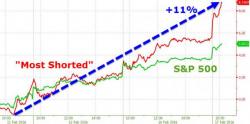

Credit Suisse Asks "How Much Of This Rally Is Short Covering" And Answers

Yesterday, when summarizing the latest torrid move in stocks higher, we said that stocks surged 'on the biggest short-squeeze in 4 months."

Today, Credit Suisse picks up on this theme and asks "how much of this rally is short covering?" The bank's answer: "Looks like a lot based on this prime services data."