Jose Canseco Says "Everyone Should Be In Gold", Predicts $1,500 By Memorial Day

In the aftermath of the BOJ's stunning NIRP announcement in late January, virtually everyone had an opinion on what this move of sheer desperation means.

In the aftermath of the BOJ's stunning NIRP announcement in late January, virtually everyone had an opinion on what this move of sheer desperation means.

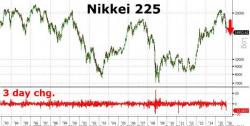

Japanese stock markets have crashed 15% (the "most since Lehman") and USDJPY plunging (most since 1998) since Kuroda unleashed NIRP and are down 11% since QQE2 was unveiled to save the world from an absent Fed. So with NIRP and QE (and jawboning) now 'useless' for Japanese monetary policy, there is only one option left - Yentervention.

Suddenly it all stopped working..

As Central Banker faith falters...

Overnight saw some hints at this beginning to happen, as Bloomberg reports,

Submitted by Stefan Gleason via Money Metals Exchange,

"The last duty of a central banker is to tell the public the truth."- Alan Blinder, former Federal Reserve Board Vice Chairman

The Federal Reserve Board finds itself back in a quandary of its own making. When Fed chair Janet Yellen pushed through an interest rate hike this past December, she confidently cited an "economy performing well and expected to continue to do so."

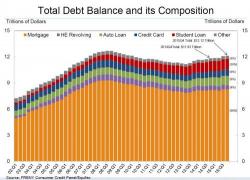

For those who follow the monthly consumer credit report released by the Fed there was nothing surprising in today's release of the latest Household Debt and Credit Report by the New York Fed. It reports that total household debt rose to $12.12 trillion in Q4, up from $11.83 trillion a year ago...

...mostly as a result of soaring student and auto debt, both trends we have observed on various occasions in the recent and not so recent past.

While the S&P 500 held support at January low (1,812) yesterday (and October 2014's Bullard bounce lows), BMO's Russ Visch warns "it may not hold in the days ahead" due to weak market breadth.

Given the ongoing collapse in market breadth (now breaking well below January's lows), BMO's Visch adds...