This Is What Central Bank Failure Looks Like (Part 4)

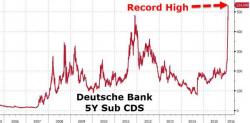

First, it was The BoJ's utter collapse from omnipotence to impotence. Then came the collapse of The Fed's credibility in the short-term.... and the longer-term. And now it is the turn of Mario Draghi's ECB to face total failure, as the European banking system - the prime beneficiary of "whatever it takes" - has crashed back to pre-Draghi levels.

As former Morgan Stanley guru Gerard Minack explains, the most corrosive factor for markets currently is the downgrading of perceived central bank potency.