It Was Never About Oil, Part 2: It Was Always Leverage & Volatility

Submitted by Jeffrey Snider via Alhambra Investment Partners,

Part 1 here...

Submitted by Jeffrey Snider via Alhambra Investment Partners,

Part 1 here...

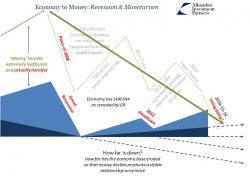

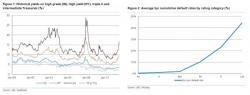

UBS' chief global credit strategist Matthew Mish has been on a roll lately. After first revealing "how the investment grade dominos will fall" in mid January (an analysis which was followed by another leg lower in IG bond prices), and then two weeks later instead of focusing on products, Mish analyzed sectors and explained "What's The Next 'Energy' Sector In Credit Markets", today he tries to put it all together and as he himself puts it, "the inquiries we have received are increasingly from investors across all asset classes and regions, and lines of questioning evolve in many directions.

On February 15 this year Russian President Vladimir Putin will keep good on his promise to ban all American corn and soybeans from being imported into Russia. Russia’s safety watchdog Rosselkhoznadzor has officially announced on Wednesday that American producers have failed to meet Russian biological standards, and that their corn and soybeans are “unfit for human consumption”.

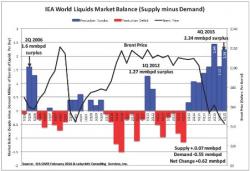

The last time front-month crude oil traded at these levels ($26.12) was May 2003 as WTI Crude has collapsed over 22% in the last 2 weeks - the biggest drop since Lehman in 2008. Goldman's "teens" are getting closer...

With credit risk already at record highs - and getting higher - we suspect the moment of Chapter 7 truth is getting closer.

Submitted by Arthur Berman via OilPrice.com,

An OPEC production cut is unlikely until U.S. production declines by about another million barrels per day (mmbpd). OPEC won’t cut because it would accomplish nothing beyond a short-term increase in price. Carefully placed comments by OPEC and Russian oil ministers about the possibility of production cuts achieve almost the same price increase as an actual cut.

Bad News About The Oil Over-Supply from IEA and EIA