Nasdaq Volatility Spikes As "Exuberance Has Turned To Panic"

With the "generals" finally meeting their reality-maker, investors appear to be questioning the DotCom bubble-like highs as momentum collapses. "Exuberance has turned to panic pretty quickly," notes one asset manager and after a very rapid plunge in recent days, options traders are piling into protection at a pace not seen since Q4 2008.

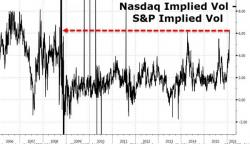

The Nasdaq-S&P implied vol spread is more than double its 5 year average...

(ignore the spikes as they represent rolls as opposed to trends)