What's Dragging Down European Banks: Oil And Commodity Exposure As High As 160% Of Tangible Book

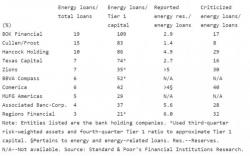

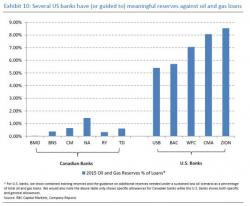

Yesterday, when looking at the exposure of the Canadian banking sector to energy, we found something disturbing: according to an RBC analysis, local banks were woefully underreserved.