Dead-Cat-Bounce Saves Stocks From Bankmageddon

Are the "fiction peddlers" winning?

Since the "great" jobs report, stocks are tanking, the dollar has roundtripped, and bonds & bullion are surging...

Are the "fiction peddlers" winning?

Since the "great" jobs report, stocks are tanking, the dollar has roundtripped, and bonds & bullion are surging...

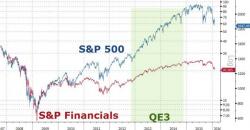

Large cap financials have had an awful time in the last month and are 11.7% lower so far in 2016.

As ConvergEx's Nick Colas details, that’s worse than pretty much anything else, including all other S&P 500 sectors, the Russell 2000 small cap index, and even the MSCI Emerging Markets Index.

“You are in a position to make 20 percent to 30 percent on your position in the fund. Why wouldn’t you buy in at Libor-plus to leverage that up?”

Good question.

That quote is from Tom Bernhardt, a senior vice president at TorreyCove Capital Partners, a San Diego-based private-equity consultant.

The echoes of both Bear and Lehman are growing louder with every passing day.

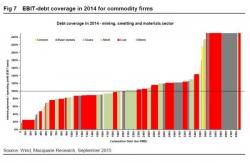

By now it is common knowledge that China has a major debt problem at the macro level, one which may be even bigger than expected because according to at least one analysis by Rabobank, China's most recent debt has soared from the infamous McKinsey level of 282% as of mid 2014, to an unprecedented 346% currently.