The War on Cash is About to Go into Hyperdrive

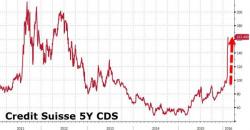

The global Central Banks have declared War on Cash.

Historically, one of the safest things to do when the markets begin to collapse is to move a significant portion of your holdings to cash. As the old adage says, during times of deflation, “cash is king.”

The notion here is that cash is a safe haven. And while earning 1-2% in interest doesn’t do much in terms of growing your wealth, it sure beats losing 20%+ by holding on to stocks or bonds during their respective bear markets