Utilities Winning By Not Losing

Via Dana Lyons' Tumblr,

While the broad stock market has been getting hammered, the utility sector hit a 52-week high this week – and achieved a significant relative breakout.

Via Dana Lyons' Tumblr,

While the broad stock market has been getting hammered, the utility sector hit a 52-week high this week – and achieved a significant relative breakout.

Everyone's favorite permabullish meteorologist, Deutsche Bank's very own Joe LaVorgna, has gone full-Zero Hedge of late, dropping the weather excuses for a decidedly bearish take on the state of the US economy.

Indeed it was just last month when LaVorgna cut his Q4 GDP estimate by "one full percentage point" citing "softer than expected data."

Ever since early 2015, we have repeated that with the world caught in a negative rate "race to the bottom", which even S&P now admits, it is inevitable that the US will join the rest of the DM central banks, especially after the flawed and much delayed attempt to hike rates into what is at least a quasi recession.

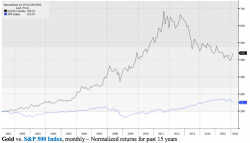

Almost every other day I read an article telling me that owning Gold is dumb or that Gold is doomed as an investment.

These articles would be useful or insightful if they weren’t based on “analysis” that is either misleading or downright wrong.

To whit…

Gold has absolutely CRUSHED stocks since 2000. During this period we’ve had two of the biggest stock market bubbles in history. Yet Gold’s performance has made stocks’ performance look like a flat-line.

H/T Bill King.

US Treasury yields are collapsing across the entire curve, down 9-10bps from their pre-opening highs this morning. While 10Y pushed belwo 1.80% (to one-year lows), it is 5Y yields that have traders the most anxious as they look to break out below three-year channel lows...

What happens next?