Why Markets Are Crashing: "Faith In Central Banks Fails"

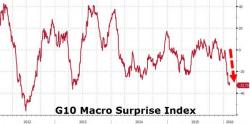

While Citigroup's Eric Lee thinks its "ridiculous" to talk fo a US recession, it appears the macro data and markets would strongly disagree: as Bloomberg reports:

Signals by central banks from Europe to Japan that additional stimulus is at the ready are failing to ease investor concern that global growth will keep slowing.