Three Reasons To Be Worried About The Economy

Submitted by Yonathan Amselem via The Mises Institute,

Submitted by Yonathan Amselem via The Mises Institute,

The bid for precious metals is accelerating. Gold just broke above its October 2015 highs to 8-month highs. Silver is also bursting higher, soaring above its 200-day moving-average.

Gold at 8-month lows...

Silver breaks 200DMA...

As Gold continues to suggest The Fed screwed up...

FANG stocks are collapsing in the pre-market as faith in the "growth at any cost" meme crashing on the shores of reality once again. Now down over 16% from their post-Fed-rate-hike highs, the stocks you should never sell are being sold in size as large crowds and small doors press NFLX and AMZN (and TSLA for good measure) down over 30% year-to-date. Even Mark Cuban is hedging...

It's carnage in the pre-open...

"For those of following my stock moves, I just bought puts against my entire Netflix position," Cuban posted on the site.

The saga of the gas giant Aubrey McClendon's built, Chesapeake Energy, enters its endgame, when moments ago following a Debtwire report that the company has hired Kirkland and Ellis as its restructuring/bankruptcy attorney - typically a step taken just weeks ahead of a formal Chapter 11 filing - the stock has plunged 22% to $2.40, the lowest price in the 21st century, and for all intents and purposes, ever.

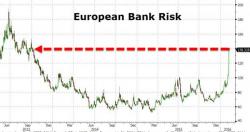

Just as we warned, not only is it time to panic but the panic is 'contagion'-ing over into the sovereign risk market. European banks are in freefall, down over 4.3% broadly, crashing to 2012's "whatever it takes" lows.

European bank risk has gone vertical... Today's spike is the largest since April 2010

TBTF banks are all seeing credit risk explode - to 52-week highs and beyond...

Slamming European bank stocks back to near "whatever it takes" lows...