Last Pillar Standing Breaks - They're Taking Out The "Generals"

Via Dana Lyons' Tumblr,

The relatively few leaders (aka, “generals”) that had been propping up the indexes are being systematically taken out.

Via Dana Lyons' Tumblr,

The relatively few leaders (aka, “generals”) that had been propping up the indexes are being systematically taken out.

Just ten days ago, in the aftermath of the BOJ's -0.1% NIRP announcement, we reported that after more than one year after the ECB unleashed NIRP, the total number of government bonds with negative yields to a staggering $3 trillion, a number which nearly doubled overnight to $5.5 trillion.

Overnight in a historic event, the latest consequence of the BOJ losing control, the yield on Japan's 10Y JGB dropped below zero for the first time, in the process joining Switzerland as the only other country (for now) with a NIRPing benchmark 10Y treasury.

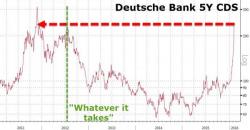

With Deutsche Bank credit risk exploding and stock price collapsing to record lows, despite the CEO's "rock solid" affirmations, there is only one way to know just how real a crisis this is... when government officials issue 'denials'.

German Finance Minister Wolfgang Schaeuble says he isn’t worried about Deutsche Bank.

“No, I have no concerns about Deutsche Bank,” Schaeuble says

Schaeuble comments to Bloomberg Television after press conference in Paris.

Moments ago, in response to DB's open querry on Twitter whether the Dax is "overreacting", we highlighted DB's soaring CDS and asked if perhaps the market was not underreacting.

Minutes later the market opined, by sending DB stock to new all time lows.

"Worse than Lehman..."

And that has crushed the entire Geman stock market...

When it rains it pours...

The market has taken over The Fed's role - forget above 25bps here or there, the cost of funding for even the highest quality US Corporates is exploding...

Simply put, the credit cycle has turned and is accelerating rapidly - crushing any hopes for debt-funded shareholder-friendliness.