Global Stocks Enter Bear Market

With stock markets from every continent plunging (Japan most recently), it should be no surprise that MSCI's world index has entered a bear market - dropping over 20% from its April 2015 record highs. However, as Gavekal notes, while much of the drag on global stocks is from collapsing emerging markets, the average developed market stock is down 23% in the past year.

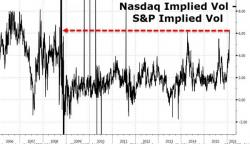

The World enters a bear market... at a crucial level...