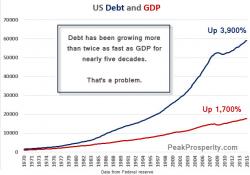

"I Don't Trust Deutsche Bank" David Stockman Unleashes Truth Bomb: "When The Crunch Comes, Bank CEOs Lie"

Following this morning's proclamation by Deutsche Bank co-CEO John Cryan that Germany's largest bank is "rock solid," David Stockman exposed the ugly truth that everyone appears to have forgotten from just 7 years ago...

"in my experience is that when the crunch comes, bank CEOs lie"

Stockman details the Morgan Stanley, BofA, Lehman, and Bear Stearns bullshit that occurred before exclaiming...