"Few Are Yet Willing To Admit The Harsh Reality..."

Excerpted from Doug Noland's Credit Bubble Bulletin,

Excerpted from Doug Noland's Credit Bubble Bulletin,

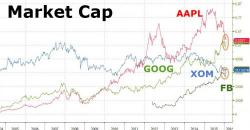

On the first day of this month, Google.. er, Alphabet.. turned in an impressive quarter.

Revenues soared 18% Y/Y while Q4 earnings were $8.67/share, well above the $8.08 the Street was looking for and a whopping $2 more than Q4 2014. Paid clicks rose by more than a third while FCF rose to $4.3 for the period. In short, just about everything looked great with the possible exception of CPC, which dropped 13%.

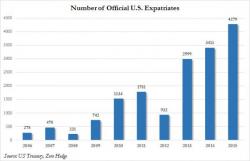

Another year, another record number of Americans willing to not only pay the $2,350 fee, but also appear in the US Treasury's "name of shame" list published every, quarter which reveals all the now-former US citizens who have decided to hand over their US passport back to Uncle Sam and expatriate.

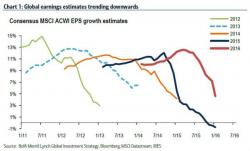

Several days ago, we showed the one chart which explains why Bank of America remains a stubborn non-BTFDer. This is what Michael Hartnett said last Thursday: "We remain sellers into strength in coming weeks/months of risk assets at least until a coordinated and aggressive global policy response (e.g. Shanghai Accord) begins to reverse the deterioration in global profit expectations (currently heading sharply south – Chart 1) and credit conditions."

Submitted by Paul Bordsky via Macro-Allocation.com,

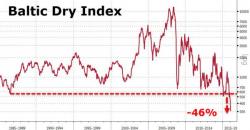

It seems monetary policy is exhausted and the next exogenous lever to pull would be political fiscal initiatives. If/when they fail to stimulate demand, there would be only one avenue left – currency devaluation. If/when confidence in the mightiest currency wanes, we would expect the US dollar to be devalued too - not against other fiat currencies, but against a relatively scarce Fed asset.

Seriously Squirrely