After Crashing, Deutsche Bank Is Forced To Issue Statement Defending Its Liquidity

The echoes of both Bear and Lehman are growing louder with every passing day.

The echoes of both Bear and Lehman are growing louder with every passing day.

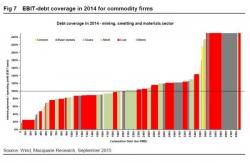

By now it is common knowledge that China has a major debt problem at the macro level, one which may be even bigger than expected because according to at least one analysis by Rabobank, China's most recent debt has soared from the infamous McKinsey level of 282% as of mid 2014, to an unprecedented 346% currently.

Barbarous Relic or safe haven of last resort? Since The Fed policy-error'd in December, gold is now up 22% over US equities...

Gold tops $1200 for the first ime since June 2015...

as the policy error gap widens further...

The US Treasury yield curve has plunged further today (2s10s -5bps at 107bps) breaking to its flattest since January 2008.

The curve has been flattening since The Fed began to taper QE3 and as financials begin to catch down to that ugly reality...

One wonders just what The Fed can do about this?

But it was a "great" jobs report, right?