"Everything's Great!"

Authored by Kevin Muir via The Macro Tourist blog,

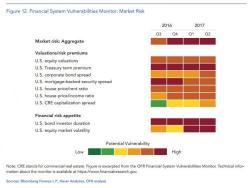

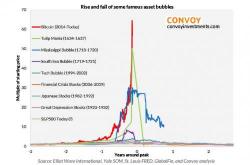

So much for that call. I thought there was no way Yellen would put her fingers in her ears, close her eyes, and shout “nah nah nah - I can’t hear you” to the speculative fervour that has gripped markets. Well, there is no way to couch it. I was wrong.

In her last press conference, Yellen focused on all the positives.