It's Groundhog Day Again For The Rising Rates Crowd

Via Dana Lyons' Tumblr,

Yet another attempt at rising interest rates has spectacularly fizzled out.

Via Dana Lyons' Tumblr,

Yet another attempt at rising interest rates has spectacularly fizzled out.

The US Dollar Index is crashing the most since QE1 was unleashed in Q1 2009. Following The Fed's Dudley-isms this morning desperately jawboning some dovishness back into markets, the USD has plunged but the ubiquitous risk-on rally in stocks is very evidently missing as USDJPY soars back above BoJ NIRP levels. Today's plunge is bigger than Dec 2015's ECB fail drop...

As Yen soars almost 3% in the last 24 hours, US Index is plunging against all the majors...

By the most since QE1 was unleashed in Q1 2009...

Downside risks to China’s economy are “relatively big” National Development and Reform Commission Chairman Xu Shaoshi admitted on Wednesday, but that’s not going to stop Beijing from swearing that China is growing at a near 7% clip.

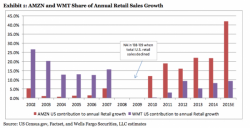

We’ve spilled quite a bit of digital ink documenting WalMart’s trials and travails since the world’s largest retailer moved last year to implement an across-the-board wage hike for its lowest-paid employees.

That decision led directly to a series of unfortunate events including a move to squeeze extra savings out of suppliers and an effort to recoup the money spent on the wage hikes by - you guessed it - firing people, including dozens at the home office in Bentonville.

As we noted last night, in what was the second clear example of sheer desperation by the Bank of Japan, the central banker formerly known as Peter Pan for his on the record belief that "he should fly", and as of this morning better known as Peter Panic, desperately tried to pull of his best "Draghi", up to and even stealing the ECB's trademark catch phrase, to wit: