Privatization Is the Atlanticist Strategy to Attack Russia — Paul Craig Roberts and Michael Hudson

Privatization Is the Atlanticist Strategy to Attack Russia

Privatization Is the Atlanticist Strategy to Attack Russia

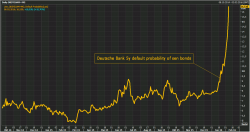

For the first time since 2012, Bafin - Germany’s banking regulator, which for a minute looked like it might actually accuse Anshu Jain of lying about LIBOR - has closed a bank.

All financial transactions by Maple Bank of Canada’s German subsidiary have been halted on the grounds the operation has too much debt or, as BaFin put it, there’s “a prohibition on transfer of ownership and payment, due to imminent over indebtedness.”

The biggest event of the weekend, if not the month, was China's FX reserve outflow update, which at $100BN was slightly better than the $120BN expected (it pushed China's reserves to the lowest in nearly 4 years) but it was in the "no man's land" between the BofA best case scenario ($37.5BN), and the GS worst case ($197BN).

Who Really Needs A Gold Standard?

Written by Jeff Nielson (CLICK FOR ORIGINAL)

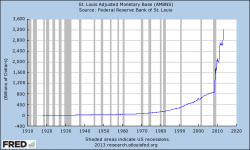

Bloomberg News recently made an astounding proclamation in a news release, by nothing less than postulating a return to a gold standard. Let me repeat. Bloomberg, a part of the mainstream media propaganda machine which often bashes all things related to gold (including the gold standard), is now advocating a return to a gold standard.