Exxon Halts Stock Buybacks As Oil Production Surges

It may not be quite as dramatic as halting a dividend for already profusely sweating investors, but when it comes to the impact on the stock price, buybacks traditionally pack far more punch.

It may not be quite as dramatic as halting a dividend for already profusely sweating investors, but when it comes to the impact on the stock price, buybacks traditionally pack far more punch.

Biometric banking is coming to ATMs, testing is already underway. The new ATM concept would allow people to unlock their bank accounts with an eye scan. However, the technology that will do away with the need for cards in favor of iris scanners is being developed by a company accused of election fraud Activist Post reports: The video below makes the same plea to embrace new technology that is always heard when discussing a solution to the very real threat of identity theft. However, it is worth noting that in this case the company which is developing the solution is Diebold.

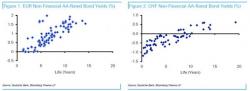

As a result of the rush to global NIRP, which now sees central banks and their sovereigns accounting for over 25% of global GDP, amounting to around $6 trillion in government bonds, trading with negative yields, a question has emerged: when will corporate bonds follow this govvie juggernaut and how soon until investors pay not government but companies to borrow?

That is the focal piece in today's note by our favorite DB credit strategist Jim Reid who muses as follows:

The ink was not yet dry on the seemingly endless Monsanto-Syngenta on again/off again takeover drama, when moments ago in a shocking development the newswires were lit up with news that a new, and very much unexpected, bidder has emerged for the Swiss pesticides giant Syngenta: China National Chemical Corp, or ChemChina as it is known, which according to WSJ and BBG is set to pay $43.7 billion to acquire a piece of Swiss corporate history.