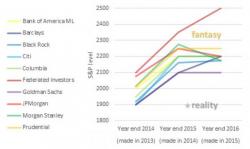

An Escalator Of Optimism

Submitted by Salil Mehta via Statistical Ideas blog,

Submitted by Salil Mehta via Statistical Ideas blog,

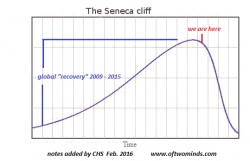

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Systemic fragility doesn't respond to central bank jawboning or Keynesian claptrap; unlike those "policy tools," fragility is real.

What The Bank of Japan gives, The Japanese Finance Ministry taketh away...

Artist's impression of the last few days in crude, JPY, and US stocks...

Submitted by Ken Wells via OilPrice.com,

“What we have here is a failure to communicate.” That’s what the warden says to Paul Newman in the movie Cool Hand Luke, right after he knocks him into a ditch. The oil and gas industry has its own failure to communicate and the longer prices bump along the bottom, the worse it seems to be getting.

Are stocks cheap? Is the 'Stock-Market' "priced-for-perfection"? Here is your answer...

The answer is - Yes and Yes-er!

h/t @Not_Jim_Cramer

Simply put, the S&P 500's forward earnings based valuation has never (in the history of the time series) been higher relative to consensus expectations of economic growth... ever.